What started as an embarrassing business dinner became one of the most important meals in the payments industry. While there are variations of the story of how the first credit card came to be, here is one of the more well-known versions.

In 1949, Frank McNamara was having a business dinner in Major’s Cabin Grill in New York City where panic struck, he realised he had left his wallet in another suit and couldn’t pay for the meal. Eventually, his wife came to the rescue and bailed him out of the awkward situation. Resolved to never face such embarrassment again, Frank partnered with Ralph Schneider to create a solution that doesn’t require him to carry around a big stack of cash, leading them to establish the first Diner’s Club credit card, one of the card schemes that Goldpac is accredited by.

The First Credit Card Transaction

A year later, Frank returned to Major’s Cabin Grill with his cardboard Diner’s Club Card and made the first ever credit card transaction in history. This meal, which was hailed as the First Supper, paved the way for the world’s multipurpose charge card industry.

While at the time, many stores and restaurants already had cards that offered store credit which can be repaid at a later date, the Diner’s Club card was the first “single-bill credit card” that can be used in various restaurants across New York city.

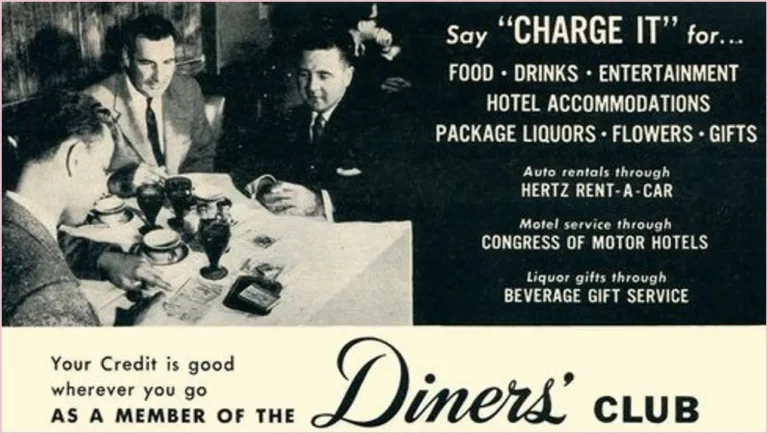

The concept began as a subscription membership for New York’s business elites. Starting with 200 members which grew to 10,000 within the first year, the small cardboard card allowed members to enjoy the convenience of settling their meals monthly within the network 28 restaurants and 2 hotels. The card then gained great popularity as more and more businesses started to accept it including shops and travel agencies, driving the club the reach one million Clubmembers internationally by the end of the decade.

Merchants’ Dilemma

However, as with most new revolutionary business concepts, the Diner’s club faced the challenge of attracting merchants during its infancy to accept the credit card as a form of payment.

In the beginning, the model of Diner’s Club card was for the merchant to pay a percentage of each transaction to Diner’s Club as a transaction fee. On top of that, if the customers were unable to pay the debt later, it was also the merchant who had to bear the risk of bad debt. For years, there were no successful solutions to change this process until 1958.

Bank Americard – Evolution into Visa

In 1958, Bank of America launched the Bank Americard, a credit card where the bank simultaneously paid the merchants for every transaction that the customer made. The bank became the party who bared the financial risk of possible bad debt but benefitted from charging customers interests and service fees.

This successful model was then licensed to other banks around the world and eventually rebranded into the card processing scheme we know today, Visa.

And that’s a story for another day. So, make sure you’re subscribed to our newsletter and connected with us on LinkedIn for more news and fun facts from the world of payments.