Compared to the heydays of manual bookkeeping, merchants calling the bank to authorise each transaction, and numerous payment frauds, credit cards have made drastic improvements to its speed and security over the last 70 years.

Some of these advancements are visible features on the cards. All these seemingly small elements are crucial to ensure fast, secure, and accurate transactions worldwide.

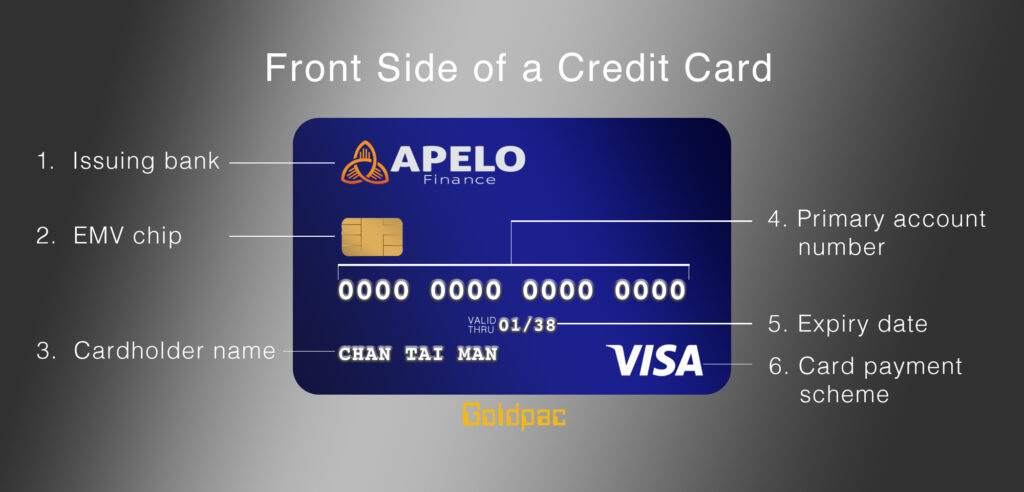

Let’s go through the details on the surface of credit cards and what their functions are. Due to the development of the technical aspect of payment cards, some elements (such as cardholder name and card number) may be printed on either side of the card now. The following layout is the traditional design that is still common around the world.

Front Side of a Credit Card

- Issuing bank: This is the bank where the cardholder has an account and applied for the payment card. It is responsible for authorizing each transaction by making sure the consumer has available credit or funds for the purchase.

- EMV chip: It is a small, integrated circuit computer chip that transmits card information to the merchant’s card reader. It is much more secure than magstripe technology (on the back of the card) as it creates a unique transaction code for each purchase rather than sharing the actual card number and account information.

- Cardholder name: Name of the account holder

- Primary account number (PAN): Each digit of the 15-to-16-digit card number allows processors, networks, and issuing banks find your account. The PAN consists of the following components:

- Bank Identification Number (BIN)/ Issuer Identification Number (IIN): It is the first six to eight digits which routes the transaction to the correct payment network and its member bank.

- Major Industry Identifier (MII): For common financial payments, the first digit of the PAN indicates which card payment network to send the transaction to for further processing. Here are the common identifiers related to banking:

- 3: Travel and entertainment (American Express)

- 4: Banking and financial (Visa)

- 5: Banking and financial (Mastercard)

- 6: Merchandizing and banking, financial or national assignments (Discover)

- Account Identifiers: The remaining digits are used by the issuing banks to identify the cardholders’ account.

- Expiry date: Indicates the validity of the payment card

- Card payment scheme: This represents the network that every transaction is processed through between the merchants, their banks, and the issuing banks.

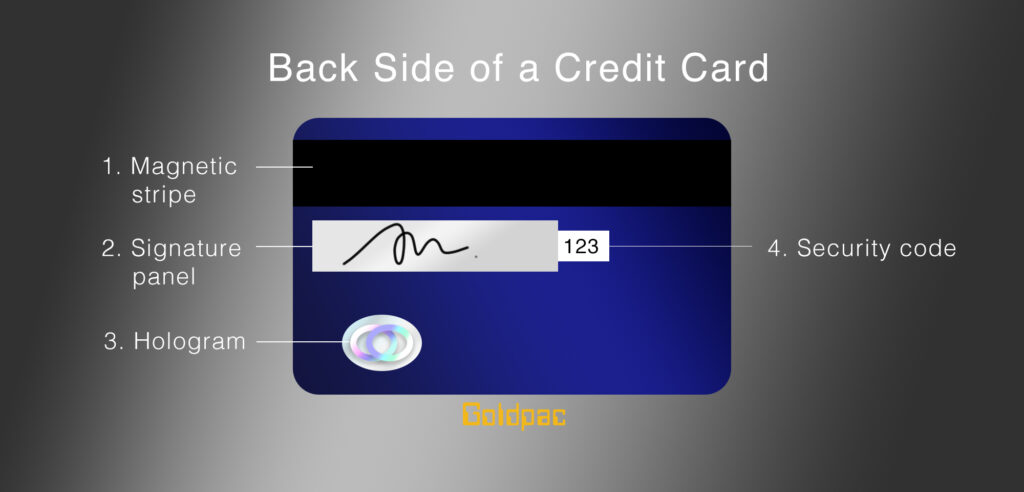

Back Side of a Credit Card

- Magnetic strip: It was a game-changing technology for the credit card and retail industry when it was invented in the 1950s. It is still currently on our payment cards due to its relatively cheap price and reading devices that still works from decades ago. But to accommodate to changing consumer habits and offer higher security measures, the magnetic strip will soon be phased out. Mastercard has announced that by 2033, none of its payment cards will bear magnetic stripes anymore.

- Signature panel: a card is only valid after a signature is present. Merchants used this to manually verify if the user is in fact the cardholder by matching the signatures, a practice that is rare nowadays.

- Hologram: These are multi-layered graphics that are difficult to for fraudster to forge and replicate. It is an additional security measure for merchants to identify valid credit cards.

- Security code: The Card Verification Code (CVC) or Value (CVV) is a 3-to-4-digit code that is used to verify the card is in your possession while performing card-not-present transactions. This code cannot be stored on the magnetic stripe or EMV chip to prevent attackers who has your cardholder information from using your card anywhere.

Though we can’t visually see the processing of each credit card transaction, it’s impressive to realise some of the procedure and security measures that goes on behind-the-scenes within just a few seconds. The advancements have come a long way since the start of the very first payment card with revolving credit.